Micro-finance is the provision of financial services, such as loans, savings, insurance, and other basic financial products, to individuals or small enterprises without access to standard banking services. These financial services are largely aimed at low-income populations, particularly women, small business owners, and rural communities, with the goal of improving their economic conditions and providing them with chances to generate money.

Table of Contents

The primary goal of micro-finance is to promote financial inclusion by ensuring that even the poorest segments of society have access to credit and financial services to improve their livelihoods.

Micro-finance institutions (MFIs) believe that small loans and financial services can significantly reduce poverty by assisting individuals in starting small enterprises, investing in income-generating activities, and managing financial risks.

Key features of micro-finance include:

- Small loan amounts: Micro-finance often entails small loans, also known as microcredit, that are offered without the requirement for collateral.

- Borrowers, particularly in rural regions, frequently organise associations in which members guarantee one another’s debts, resulting in a sort of social collateral.

- Low transaction costs: Micro-finance organisations strive to keep costs low by reducing paperwork and implementing community-based loan disbursement and collection mechanisms.

- Many micro-finance programmes focus on women and marginalised groups since they are frequently excluded from traditional financial systems and are perceived to be more likely to invest in the well-being of their families and communities.

Role of Microfinance in Poverty Alleviation

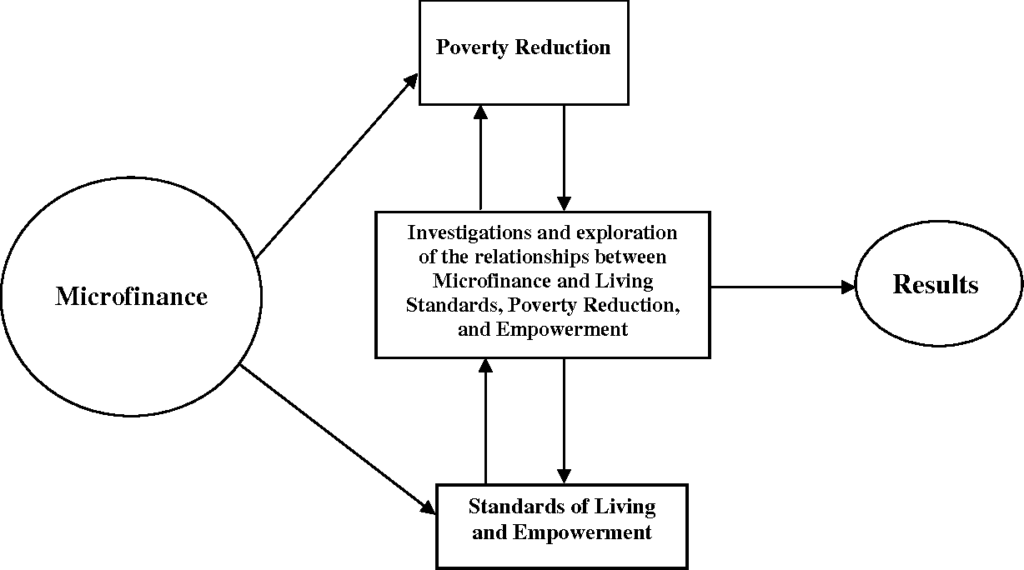

Microfinance plays a crucial role in poverty alleviation by providing low-income individuals and communities with access to financial resources that help them improve their economic conditions. Here are some ways in which microfinance contributes to reducing poverty:

- Microfinance encourages entrepreneurship and income generation by allowing those without access to traditional financial institutions to borrow small amounts of capital. These loans enable people to develop or expand small companies such as stores, farms, handicrafts, and other micro-enterprises. Through these initiatives, they can earn money and become financially independent, raising their level of living.

- Empowers Women: In many countries, microfinance programmes are specifically designed for women, who frequently face larger barriers to financial access. Microfinance helps women by providing loans and financial services, allowing them to develop their own enterprises and participate in the economy. Women’s income is frequently directed towards education, healthcare, and nourishment for their family, resulting in significant ripple effects for poverty reduction.

- Encourages Savings and Financial Management: Microfinance organisations also provide savings programmes, allowing low-income clients to accumulate assets over time. Saving allows people to deal with financial emergencies, invest in education, and increase general economic stability. Access to savings accounts encourages a culture of financial management in low-income households, allowing them to plan for the future and decrease their exposure to economic shocks.

- Reduces Vulnerability and Financial Exclusion: Poor people are often vulnerable because they lack access to insurance and financial safety netts. Micro-finance organisations typically provide microinsurance products to safeguard low-income people from risks such as illness, crop failure, and natural catastrophes. Microfinance improves people’s ability to manage risks and overcome poverty by eliminating financial exclusion.

- Boosts Local Economies: When microfinance programmes succeed in encouraging entrepreneurship and increasing home income, the economic benefits spread across the community. Small businesses create local jobs and drive demand for goods and services. This has a multiplier effect, improving the overall economic health of the town.

Practices of Microfinance in Nepal

Microfinance has emerged as an essential tool for poverty alleviation and rural development in Nepal. Given that the majority of Nepal’s population lives in rural areas with limited access to formal financial services, microfinance has emerged as an important method for expanding financial inclusion and supporting income-generating activities.

Key practices of microfinance in Nepal include:

- Microfinance Institutions (MFIs): Nepal has a variety of MFIs that offer microcredit and other financial services to poor and marginalized communities. These institutions include:

- Cooperatives: Community-based cooperatives are popular in Nepal, particularly in rural areas. They provide savings and credit services to their members, pooling resources from local communities to fund loans for small businesses, farming, and other income-generating activities.

- Microfinance Development Banks: Several microfinance development banks operate in Nepal, providing loans, savings products, and financial literacy programs to low-income individuals. These banks often focus on empowering women, rural communities, and small entrepreneurs.

- NGOs: Many non-governmental organizations (NGOs) in Nepal work in microfinance, providing loans, training, and other financial services to the poor. They typically work at the grassroots level, focusing on capacity building and financial literacy alongside loan disbursement.

- Group Lending Model: One of the most prevalent forms employed in Nepal is group lending, in which members of a community organise small groups to guarantee each other’s loans. This technique lowers the risk for lenders while encouraging borrowers to repay loans on schedule. The group financing strategy has been particularly effective in reaching women and rural people, who may lack collateral yet benefit from social capital.

- Focus on Women: Many microfinance banks in Nepal cater exclusively to women, recognising their importance in home financial management and community development. Women are frequently regarded as more dependable borrowers, and their earnings are more likely to be invested in enhancing family well-being, notably in education and healthcare.

- Inclusive Financing for Marginalized Communities: Microfinance in Nepal focuses on providing financial services to marginalised and disadvantaged populations, including Dalits, indigenous communities, and individuals living in remote locations. These people often have limited access to standard banking services, hence microfinance is an important instrument for their economic development.

- Savings and Micro-insurance Programs: In addition to credit, several Nepalese microfinance companies provide savings programmes and microinsurance products to help clients manage risk and create financial resilience. Savings plans encourage low-income people to save money for future needs, whereas microinsurance protects against financial shocks caused by health problems, natural catastrophes, or other unforeseen events.

- Challenges and Opportunities: Despite microfinance’s success in fostering financial inclusion, Nepal still faces significant hurdles. These include low levels of financial literacy among rural populations, the high expense of reaching isolated regions, and problems in assuring loan payback in places hit by natural disasters or political instability. However, the growth of digital financial services and mobile banking creates new chances to expand the reach and effectiveness of microfinance programmes.

Conclusion

Microfinance in Nepal contributes significantly to poverty eradication by providing financial services to marginalised and underprivileged people. Microfinance enables individuals, particularly women and rural populations, to produce income, better their lives, and minimise their vulnerability to financial hazards by providing microcredit, savings programmes, and microinsurance. While there are hurdles to scaling up and guaranteeing sustainability, microfinance is a useful strategy for boosting financial inclusion and reducing poverty in Nepal.

Frequently Asked Questions (FAQs)

What is the role of microfinance in Nepal?

MFIs in Nepal primarily serve microentrepreneurs that own or are beginning very tiny businesses, known as microenterprises.

What is the role of poverty alleviation?

Poverty reduction, often known as poverty relief or alleviation, is a collection of economic and humanitarian initiatives aimed at permanently lifting people out of poverty.

What are the 5 principles of microfinance?

These are Principle 1 (Objectives, independence, powers, transparency and cooperation), Principle 4 (Transfer of significant ownership), and Principle 5 (Major acquisitions).

Related Article